Lender Credits and Cash Programs

Lender Credits & Using Cash for Closing Costs: What You Need to Know

When buying a home, getting a HELOC, or refinancing your mortgage, you’ll have to pay closing costs. These costs can include things like appraisal fees, title insurance, and lender fees. For a HELOC, closing costs and fees usually range from 2% to 5% of your credit limit, but they are often lower than those for a home equity loan.

What Are Lender Credits?

Lender credits are essentially funds provided by your lender to help cover some or all of your closing costs. These credits can come from lender promotions, third-party affiliations, or specific borrower programs.

How it works:

- If your mortgage, HELOC, or refinance situation qualifies, you may be eligible for certain promotions or programs.

- Lender credits reduce the amount of cash you need to bring to closing.

- Sometimes, lender credits are offered in exchange for a slightly higher interest rate.

Can You Use Lender Credits or Cash for a HELOC or Refinance?

- HELOC: Some lenders offer credits or allow you to roll closing costs into your line of credit.

- Refinance: Lender credits are common, or you can pay costs with cash.

What Are The Closing Costs That The Lender Charges?

Lenders and mortgage brokers may charge various fees for their services. Common examples include:

- Discount Points: Upfront payments to lower your interest rate. Usually 0–3% of the loan amount, paid at closing. Discount points can save you money over time if you plan to stay in your home for several years.

- Origination Fees: Paid directly to your lender or broker for their service in processing your loan.

- Processing/Underwriting Fees: Paid for the lender’s work in processing and underwriting your loan.

Lender Credits and “No-Cost” Refinances

Homeowners often refinance to lower monthly payments or access equity for things like debt consolidation or home improvements. Closing costs on a refinance loan can range from 2% to 6% of your loan amount.

When considering a refinance, always factor in all associated costs—title fees, appraisal fees, origination fees, and more—so you have a clear picture of the total expense before making a decision.

How American Mortgage Xpress Can Help

At American Mortgage Xpress, our Loan Originators work with a variety of lenders to find the right fit for your unique financial situation. We shop for competitive interest rates, lower closing costs, and other factors that impact your ability to qualify for a loan. Some of our partners offer promotions that allow us to provide borrowers with credits toward closing costs, reducing your out-of-pocket expenses. Ask us about current programs you might qualify for!

Disclosures and More Info

- 1 Home Equity Loan product requires full documentation of income and assets, credit score, and maximum loan-to-value (LTV), combined loan-to-value (CLTV), and home equity combined loan-to-value (HCLTV) ratios.

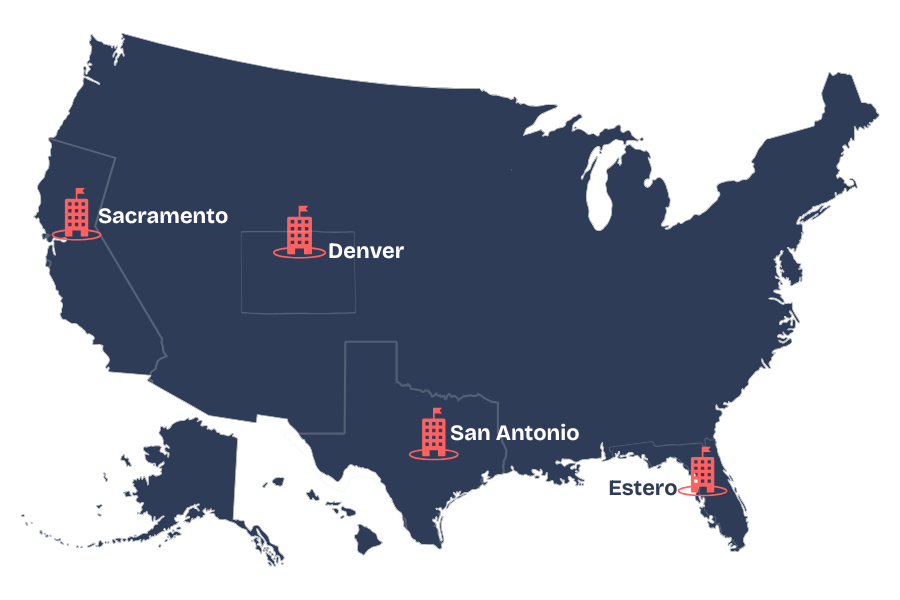

- American Mortgage Xpress (AKA AMXpress) NMLS#2502574 is not an agency of the federal government. Mortgage Brokers Near Me in Florida, Texas, Colorado, and California CA-DFPI2451289.

- For licensing information, please visit NMLS Consumer Access.

- Approved by HUD/FHA, Fannie Mae, Freddie Mac, and Ginnie Mae. This is not a credit decision or a commitment to lend. Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Borrowers must qualify at closing for all benefits.

Can I buy a house with no money down?

When buying a home, getting a HELOC, or refinancing your mortgage, you’ll have to pay closing costs.

FHA Loans with Down Payment Assistance

Navigating the world of home buying can be overwhelming, especially for first-time buyers. Fortunately, Federal Housing Administration (FHA) loans, coupled with down payment assistance programs,

HELOC RATES

Navigating the world of home buying can be overwhelming, especially for first-time buyers. Fortunately, Federal Housing Administration (FHA) loans, coupled with down payment assistance programs,

Understanding Lender Credit and Cash

When buying a home, getting a HELOC, or refinancing your mortgage, you’ll have to pay closing costs.

USDA Loans with No Down Payment Required

Navigating the world of home buying can be overwhelming, especially for first-time buyers. Fortunately, Federal Housing Administration (FHA) loans, coupled with down payment assistance programs,