Current home equity line of credit (HELOC) rates

TDLR;

HELOCs remain a popular option for homeowners who want flexible, cost-effective access to their home’s equity. With rates currently averaging ~8.12%,

Pro Tip:

As licensed mortgage advisors, we can help you determine if a HELOC is the right fit for your needs and provide you with an exact, personalized quote based on your unique situation. Reach out to us for the most current rates and tailored guidance.

National HELOC Interest Rate Trends: What Homeowners Should Know

HELOC Rates: Current Snapshot

As of the latest data, the average rate for a $30,000 home equity line of credit (HELOC) is around 8.12%, according to Bankrate’s national survey of lenders. While rates can change week to week, keeping an eye on the national average helps you make informed decisions about tapping into your home equity.

Tip: Always check for the most recent HELOC rates before applying, as these rates are variable and can fluctuate with market conditions.

What Drives HELOC Rates?

HELOCs typically come with variable interest rates. These rates move in tandem with the prime rate, which is itself influenced by the Federal Reserve’s monetary policy decisions. When the Fed holds rates steady, as it did in its recent meetings, HELOC rates tend to stabilize. However, any future changes by the Fed—such as a rate cut—could quickly impact what you pay on your line of credit.

Is a HELOC Right for You?

If you’re considering home renovations, debt consolidation, or need flexible access to funds, a HELOC can be a cost-effective alternative to a home improvement loan or a cash-out refinance. Unlike a refinance, a HELOC lets you keep your existing low-rate mortgage intact.

Expert insight:

“A HELOC offers more flexibility over when and how much you withdraw,” says Stephen Kates, financial analyst at Bankrate. “Borrowers anticipating changing borrowing needs, or who want open-ended access to their home’s equity, might find greater value in a HELOC. Its flexible draw period and variable rate can be advantages for those expecting rates to decline and who are comfortable with changing loan terms.”

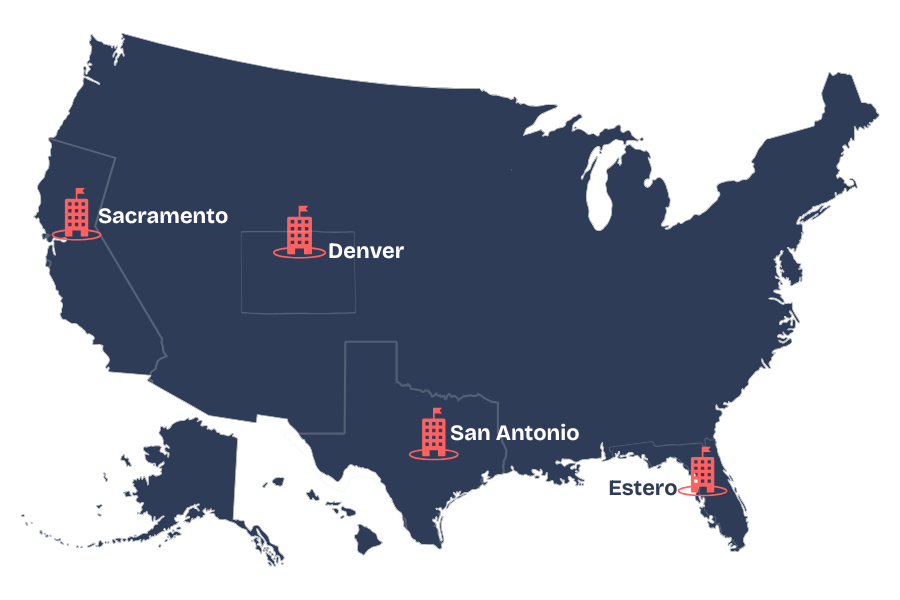

American Mortgage Xpress

Who we are: American Mortgage Xpress is a mortgage broker and borrower advocate, dedicated to helping clients find the best mortgage solutions for their needs.

What we do: We offer expert advice and a range of mortgage products, including HELOCs (Home Equity Lines of Credit), and can provide you with an exact quote tailored to your unique financial situation.

Licensed Advisors: Our team consists of licensed mortgage advisors who are ready to guide you through every step of the mortgage process and ensure you get the most current rates available.

Now Hiring: We are currently seeking Mortgage Loan Originators (MLOs) in FL, TX, CO, and CA.

Contact: For more details or to get a personalized quote, reach out to us directly.

Note:

This blog is regularly updated to reflect the latest national HELOC rates. For the most up-to-date information, check with your lender or a reputable financial news source.

Can I buy a house with no money down?

When buying a home, getting a HELOC, or refinancing your mortgage, you’ll have to pay closing costs.

FHA Loans with Down Payment Assistance

Navigating the world of home buying can be overwhelming, especially for first-time buyers. Fortunately, Federal Housing Administration (FHA) loans, coupled with down payment assistance programs,

HELOC RATES

Navigating the world of home buying can be overwhelming, especially for first-time buyers. Fortunately, Federal Housing Administration (FHA) loans, coupled with down payment assistance programs,

Understanding Lender Credit and Cash

When buying a home, getting a HELOC, or refinancing your mortgage, you’ll have to pay closing costs.

USDA Loans with No Down Payment Required

Navigating the world of home buying can be overwhelming, especially for first-time buyers. Fortunately, Federal Housing Administration (FHA) loans, coupled with down payment assistance programs,