Understanding USDA Loans: No Down Payment Required!

At American Mortgage Xpress, we believe that homeownership should be accessible to everyone, especially those looking to settle in rural areas. One of the best-kept secrets in the mortgage industry is the USDA loan program, which offers eligible borrowers the opportunity to buy a home with no down payment required. Let’s dive into what USDA loans are and how they can benefit you.

What is a USDA Loan?

The United States Department of Agriculture (USDA) created the USDA loan program to promote homeownership in rural and suburban areas. These loans are designed for low to moderate-income families who may not have the means to make a substantial down payment. The USDA loan program provides a pathway to homeownership by offering favorable terms and conditions.

Key Benefits of USDA Loans

1. No Down Payment Required

One of the most significant advantages of USDA loans is the 0% down payment requirement. This means you can finance the entire purchase price of your home, making it an excellent option for first-time homebuyers or those with limited savings.

2. Lower Interest Rates

USDA loans often come with lower interest rates compared to conventional loans. This can lead to significant savings over the life of the loan, making your monthly mortgage payments more affordable.

3. Flexible Credit Requirements

While traditional loans may require higher credit scores, USDA loans are more lenient. Borrowers with a credit score of 640 or higher typically qualify for streamlined processing, while those with lower scores may still be eligible with additional documentation.

4. Mortgage Insurance Savings

USDA loans require mortgage insurance, but the premiums are generally lower than those associated with conventional loans. This can result in lower overall costs for borrowers.

5. Support for Rural Communities

By choosing a USDA loan, you’re not just investing in your future; you’re also supporting rural communities. These loans are specifically aimed at encouraging growth and development in less populated areas.

Who Qualifies for a USDA Loan?

To qualify for a USDA loan, borrowers must meet certain criteria:

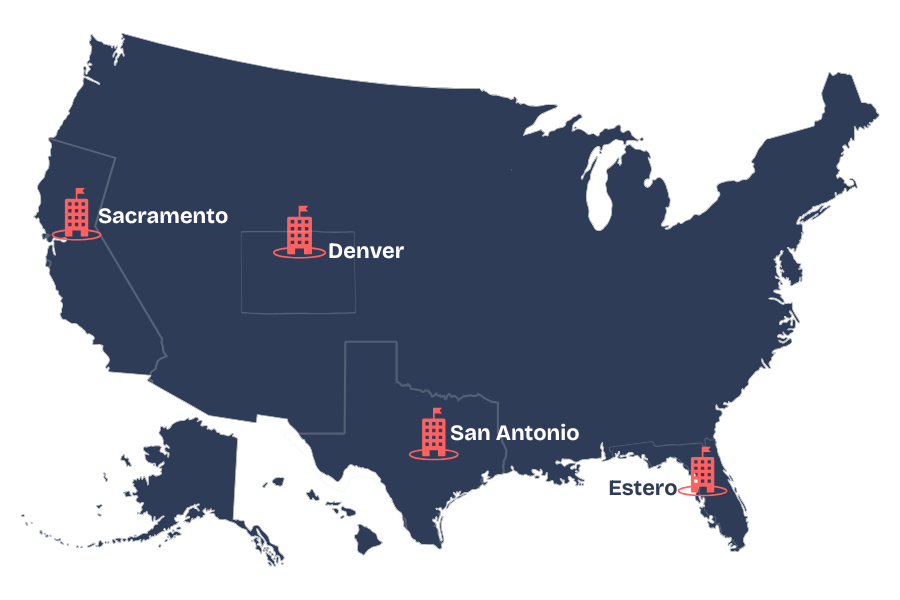

- Location: The property must be in an eligible rural area as defined by the USDA.

- Income Limits: Borrowers must meet specific income guidelines, typically not exceeding 115% of the median income for the area.

- Creditworthiness: While credit requirements are flexible, a minimum score of 640 is generally preferred.

How to Get Started

If you’re interested in exploring USDA loans and the possibility of buying a home with no down payment, the first step is to contact a mortgage professional at American Mortgage Xpress. Our team is here to guide you through the process, answer your questions, and help you determine if a USDA loan is the right fit for you.

USDA loans provide an incredible opportunity for eligible homebuyers to achieve their dream of homeownership without the burden of a down payment. If you’re considering buying a home in a rural area, don’t overlook this fantastic option. Reach out to American Mortgage Xpress today, and let us help you navigate the path to homeownership!

Can I buy a house with no money down?

When buying a home, getting a HELOC, or refinancing your mortgage, you’ll have to pay closing costs.

Understanding Lender Credit and Cash

When buying a home, getting a HELOC, or refinancing your mortgage, you’ll have to pay closing costs.

HELOC RATES

Navigating the world of home buying can be overwhelming, especially for first-time buyers. Fortunately, Federal Housing Administration (FHA) loans, coupled with down payment assistance programs,

USDA Loans with No Down Payment Required

Navigating the world of home buying can be overwhelming, especially for first-time buyers. Fortunately, Federal Housing Administration (FHA) loans, coupled with down payment assistance programs,

FHA Loans with Down Payment Assistance

Navigating the world of home buying can be overwhelming, especially for first-time buyers. Fortunately, Federal Housing Administration (FHA) loans, coupled with down payment assistance programs,